The text below is from a recent edition of Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Today, we’ll examine the evolving role that the Chicago Mercantile Exchange (CME) has played in the bitcoin futures market. In particular, we will be looking at some of the trends since the ProShares Bitcoin Strategy Futures ETF (BITO) began trading in October 2021.

We’ve covered the potential impact of a bitcoin futures ETF in The Daily Dive #080 – Impact on Bitcoin Futures ETFs.

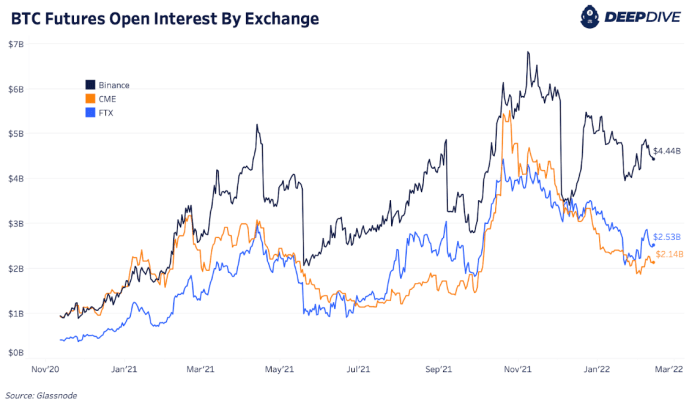

There are currently $14.7 billion worth of open interest bitcoin futures on various exchanges and contract types, a figure equivalent to 348,000 bitcoins.

An analysis of open interest by exchange shows that Binance ($4.44 billion) is the market leader, followed by FTX ($2.53 billion) and CME ($2.14 billion). These three exchanges make up the majority of open interest contracts accounting for over 60% of the market.

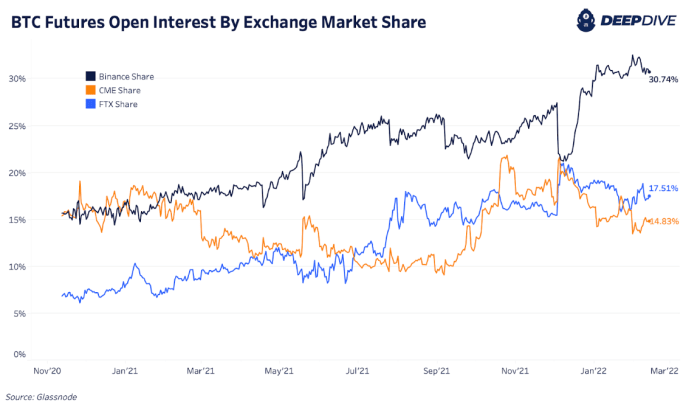

In terms of total open interest percentage per exchange, 30.74% is currently held on Binance, while FTX and CME hold 17.51% and 14.83% open interest respectively each.

Among the most interesting dynamics, when it comes to analyzing the open interest of specific exchanges in the futures market, is the rise in open interest for the CME leading to the approval of the ETF at bitcoin term.

In early October, rumors began circulating that a futures ETF was imminent and bitcoin futures open interest on the CME (where the potential futures ETF would trade its holdings) more than doubled to a high. of $5.5 billion in less than a month, briefly becoming the market leader in open interest.