The following is a direct extract from Marty’s Bent Issue #1194: “Rising energy prices, hardship and their effect on mining profitability.“ Subscribe to the newsletter here.

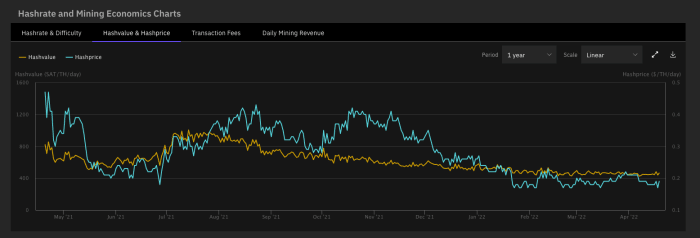

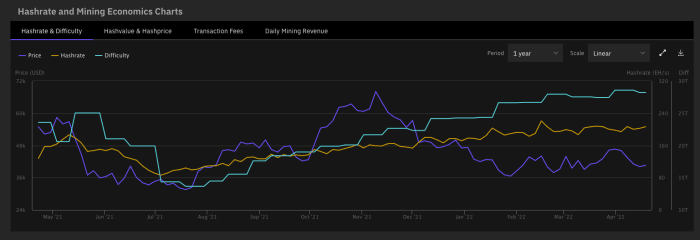

Here is an element to which we will have to pay particular attention in the coming months: the economics of the bitcoin mining industry. Bitcoin price remaining in a tight price range for the first three and a half months of the year, with hash rate and difficulty rising steadily (for the most part) alongside soaring energy prices , your Uncle Marty has his antennae reinforced with signs of struggle in the mining world. Current market conditions are certainly straining many miners right now. Especially those who don’t have (or think they have) relatively low fixed electricity prices compared to the rest of the market.

As energy prices rise and miners who made purchases a while ago start getting ASICs delivered and try to reap the benefits as quickly as possible by plugging in said ASICs as quickly as possible, by increasing the hash rate and the difficulty in the process, the market conditions are getting very tight out there for many traders. If bitcoin price remains stuck in the range it has been trading in for four months, miners continue to plug in more ASICs as they come in and energy prices continue to rise, we could see a lot of explosions in the market leading to some consolidation among players.

What will be most interesting to see is how power purchase agreements (PPAs) hold up under these conditions. Many miners who mine the grid to mine typically engage in PPAs with a fixed electricity price over a specified period of time to lock in some of their operating expenses (opex). If raw energy input prices continue to climb at the rate of last year, there is an increasing incentive for utilities that have signed these PPAs to find ways to exit these PPAs so that they can increase their margins and continue to operate. in an extreme market. Is upstream pricing pressure straining utility companies’ hands to the point of forcing them to renegotiate their PPAs mid-contract? If so, how many miners who have built-in fixed electricity costs are wiped out due to an unexpected increase in operating expenses that makes them unprofitable? Time will tell us.

Keep an eye on the relationship between energy prices, hash rate, difficulty, and bitcoin price as the timeline rolls around. You might notice a group of people getting caught with their pants down.